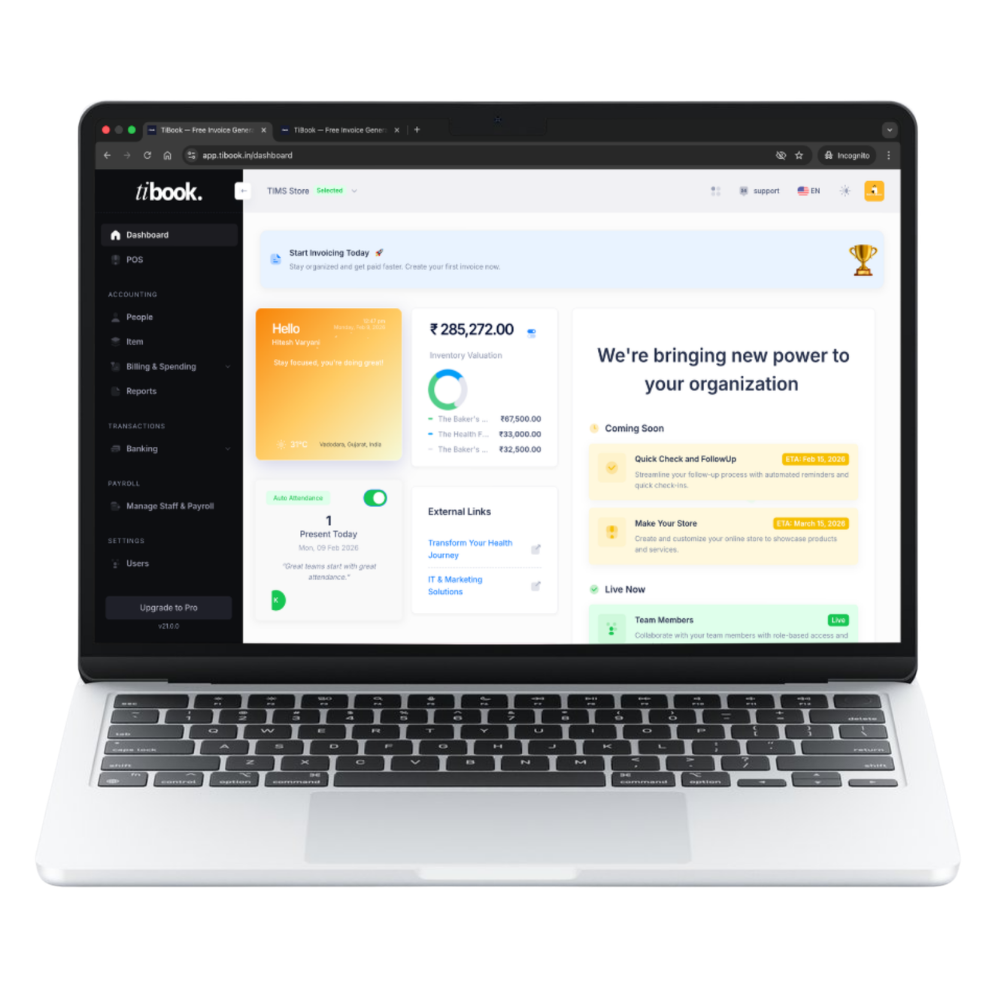

How to Create an Invoice with TiBook Invoice Generator

Creating a professional invoice in TiBook takes less than a minute — even if you've never created one before. Our smart invoice generator guides you step-by-step so you never miss important details.

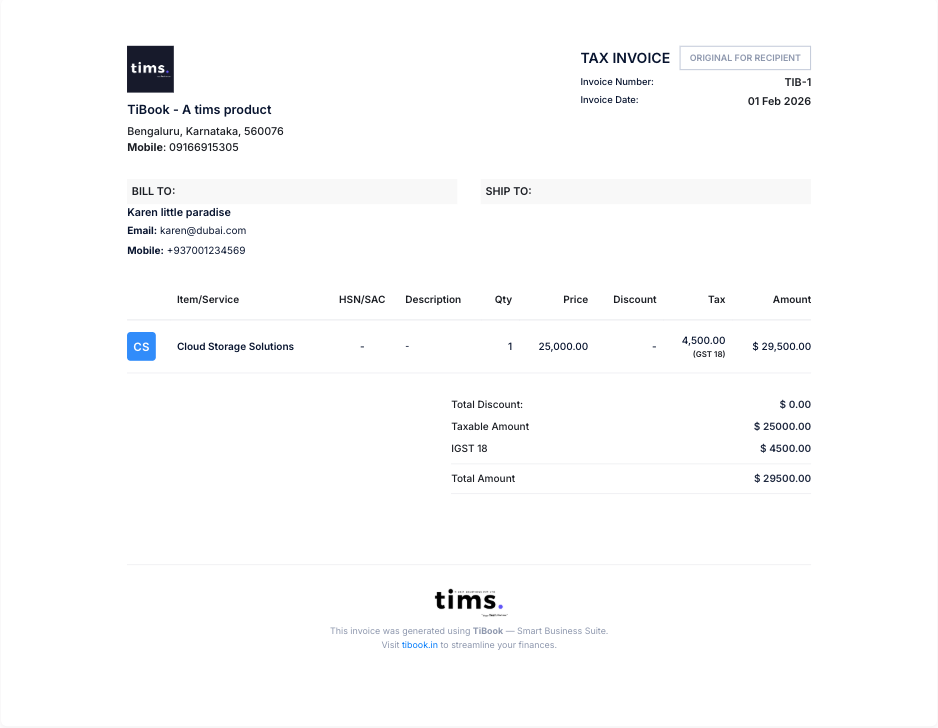

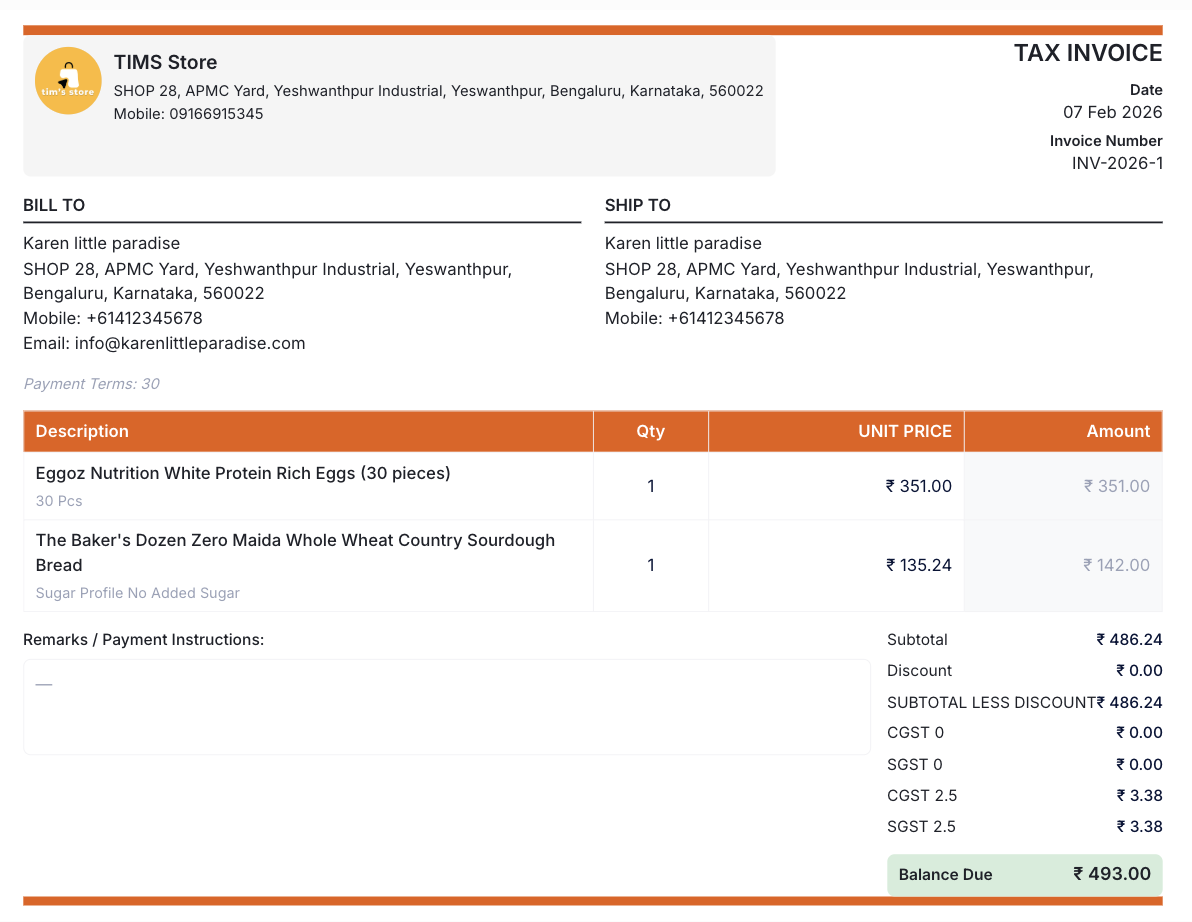

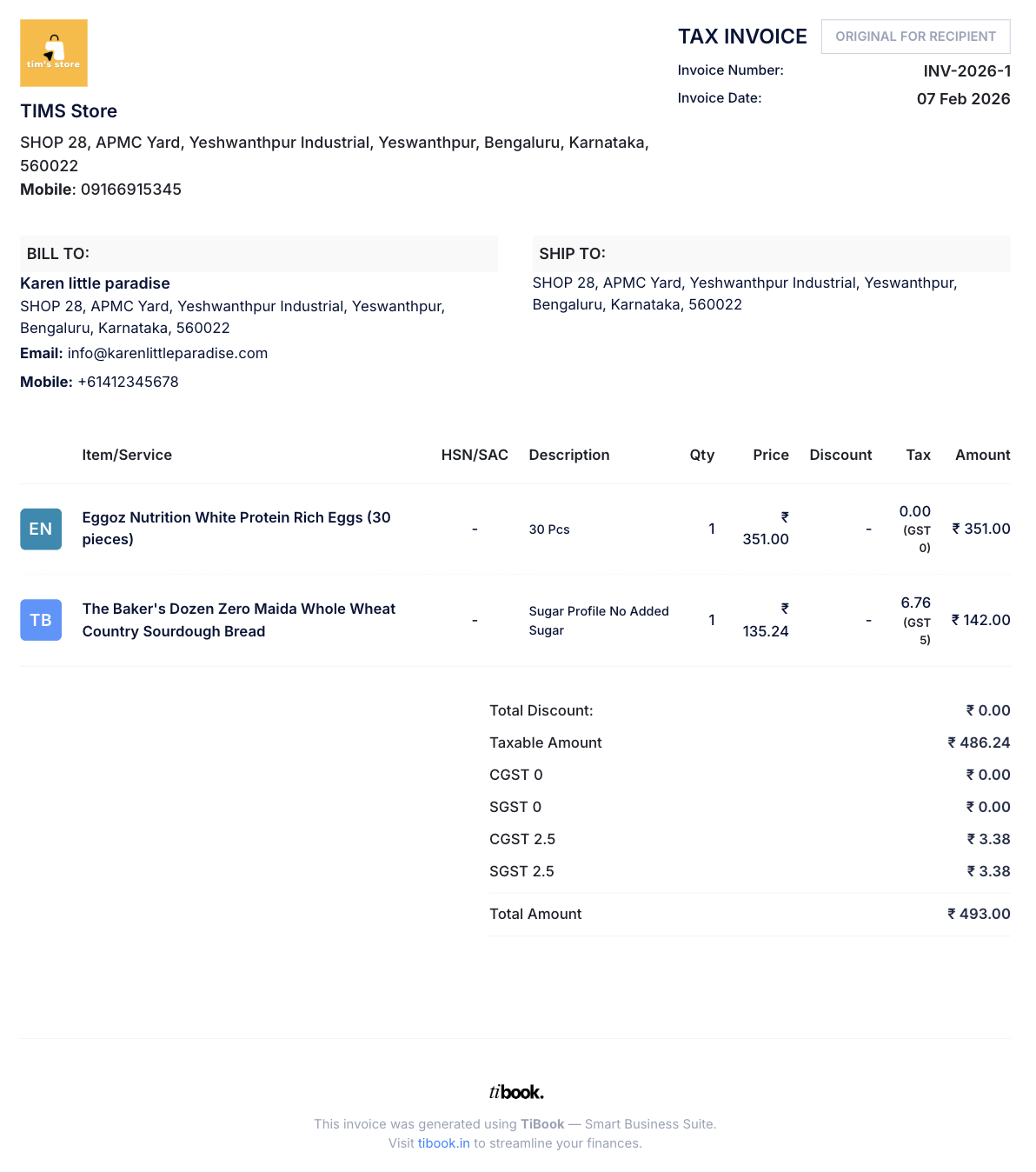

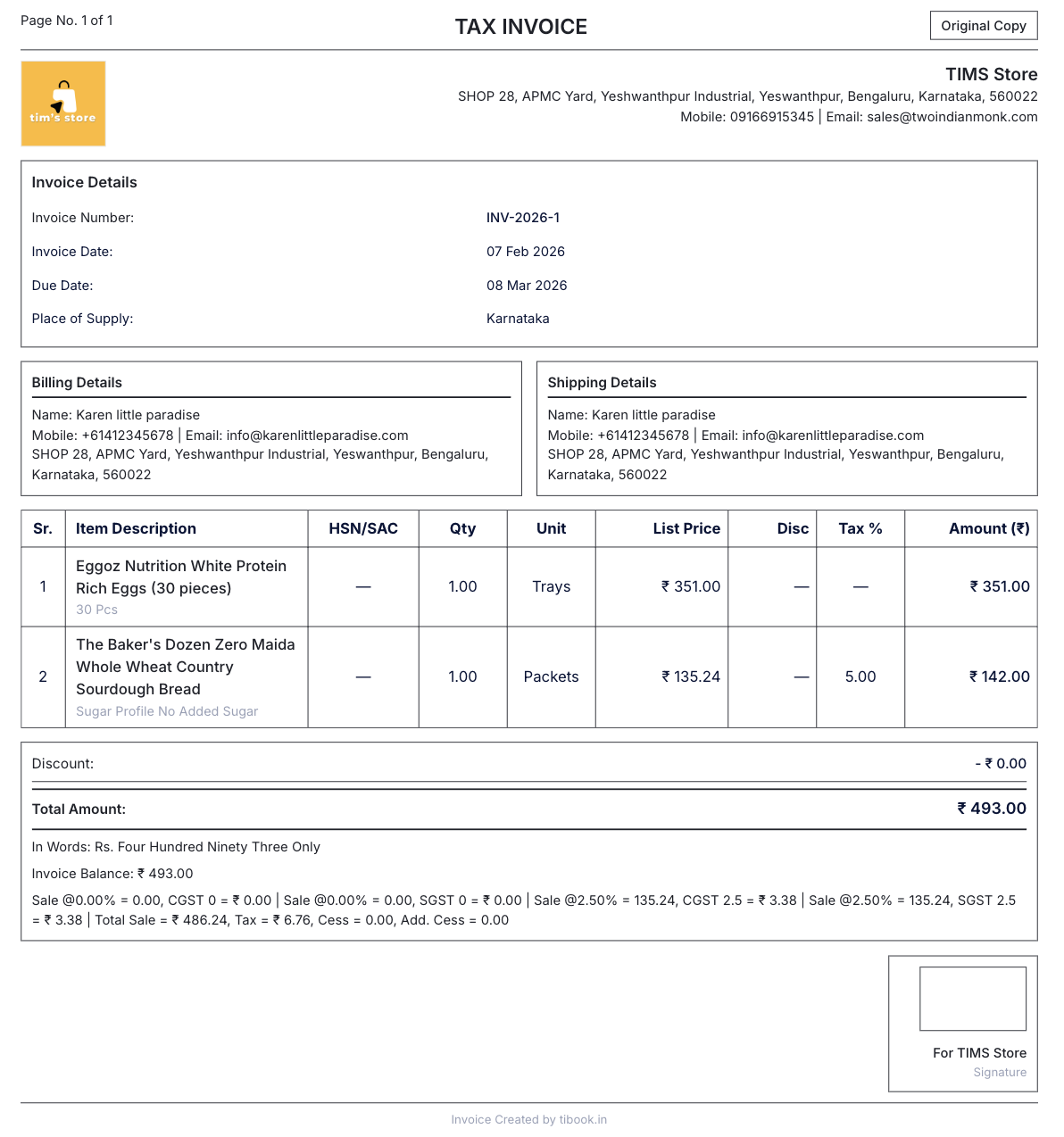

Add Business & Client Details

Enter your business information, upload your logo, and add client details. TiBook's free invoice generator saves your information for faster future use.

Add Products or Services

List your products or services with descriptions, quantities, and rates. TiBook automatically calculates totals, applies discounts, and handles tax calculations.

Download or Send Invoice

Preview your professional invoice, then download as PDF, print, or share via email or WhatsApp. No signup required with TiBook's free invoice generator.

Why Choose TiBook Invoice Generator?

Free Forever

No hidden costs. TiBook's free invoice generator is available forever with all essential features.

No Login Required

Start creating invoices instantly without signing up. Your data stays private and secure.

GST & Tax Support

Generate GST-compliant invoices for India, tax-ready invoices for US, and VAT invoices for EU.

Multi-Currency

Support for USD, INR, EUR, and more. Perfect for global businesses and freelancers.

Download PDF

Download professional PDF invoices instantly. High-quality format ready for printing or emailing.

Share via WhatsApp

Send invoices directly via WhatsApp for faster payment collection.

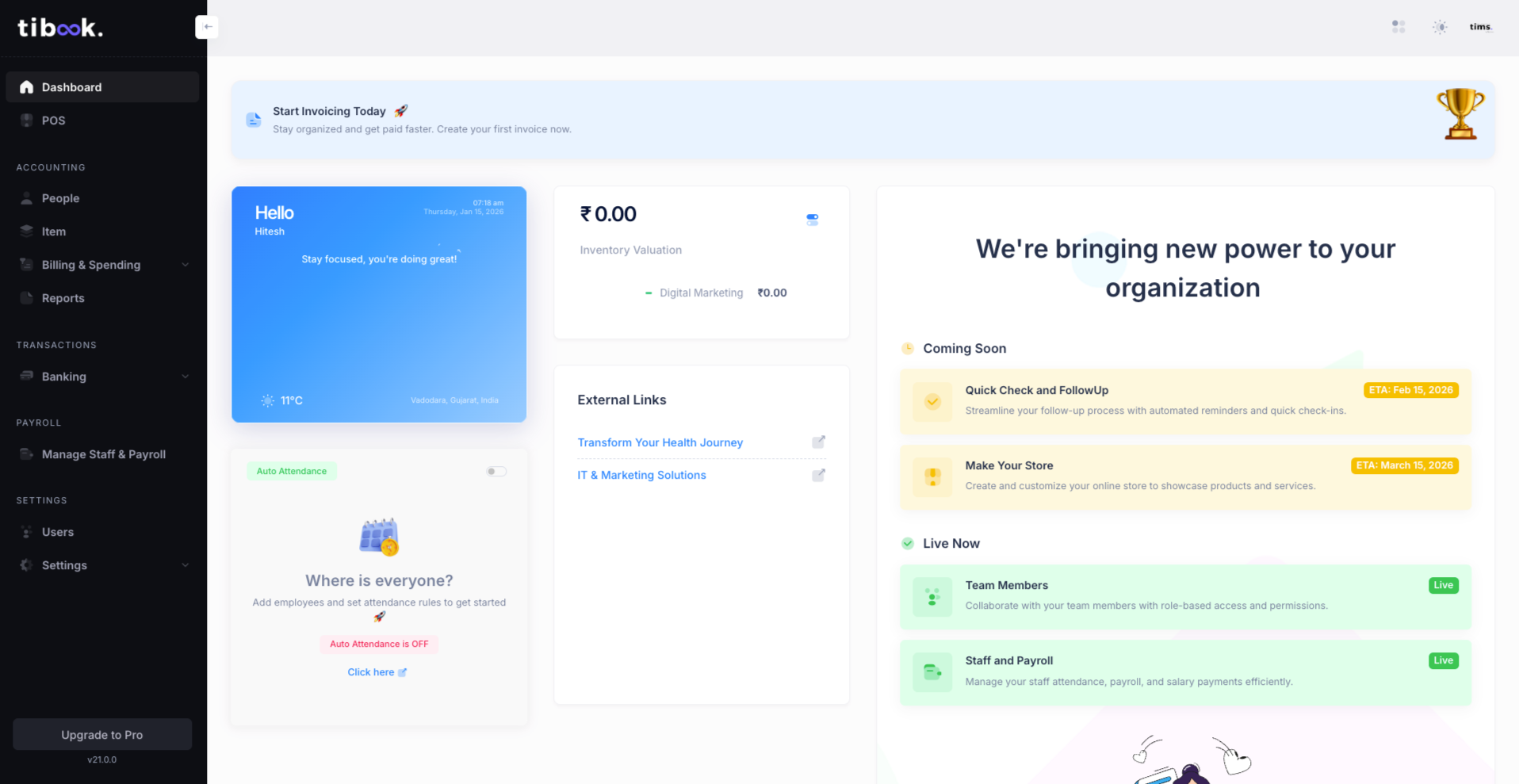

Convert to Full System

Upgrade to TiBook's complete invoicing system for payment tracking, client management, and more.

What Should an Invoice Include?

A professional invoice should include all essential details to ensure timely payment and legal compliance. Here's what TiBook's free invoice generator includes:

- Business name - Your company or business name

- Client name - Customer or company name

- Invoice number - Unique identifier for tracking

- Issue date - Date when invoice was created

- Due date - Payment deadline

- Item list - Products or services with descriptions

- Tax details - GST, VAT, or sales tax information

- Total amount - Final amount due

- Payment terms - Payment methods and conditions

How to Share an Invoice in TiBook

TiBook makes invoice sharing effortless. Once your invoice is saved, you can share through WhatsApp or Email after logging in/signing up with TiBook, send to multiple email contacts, and print hard copies using the 'Print' icon.

Professional invoices get paid faster — and TiBook ensures your invoice looks clean, clear, and trustworthy.

How to Download an Invoice in TiBook

Downloading your invoice as a PDF is simple:

- Create and save an invoice by logging into TiBook

- Be redirected to a web app to explore a preview

- Click the preview button for a full-page view and recheck

- Choose the download option and download

Your invoice is downloaded instantly in high-quality PDF format.

Benefits of Using TiBook Invoice Generator

Manual invoicing wastes time and creates errors. TiBook changes that.

Access from Anywhere

Your invoices are stored securely in the cloud. Access them from your laptop, tablet, or mobile anytime.

Error-Free Invoices

No calculation mistakes. No messy handwritten bills. Everything is auto-calculated and professionally formatted.

Professional Branding

Upload your logo. Choose clean invoice templates. Send polished invoices that build trust.

Secure & Safe Data

Your business and client data are securely stored. Role-based access ensures only authorized users can access invoices.

Faster Approvals & Payments

Clear, structured invoices reduce back-and-forth. Integrated reminders help you follow up on overdue invoices.

Free Invoice Generator Vs. TiBook Invoicing Software

Are you confused about choosing between editable invoice templates and TiBook invoicing software for managing your invoicing needs? Here is a quick comparison to help you decide the best option for generating a new invoice.

| Features | Free Invoice Template | TiBook Invoice Software |

|---|---|---|

| Business Logo | Limited | ✓ Yes |

| Editable Templates | Basic | ✓ Advanced |

| Auto Calculations | Manual | ✓ Automatic |

| Multiple Currencies | Limited | ✓ Yes |

| Share via Email | Manual | ✓ One-click |

| WhatsApp Sharing | ❌ | ✓ Yes |

| Payment Tracking | ❌ | ✓ Yes |

| Overdue Reminders | ❌ | ✓ Automated |

| Unlimited Edits | Limited | ✓ Yes |

| Client Management | ❌ | ✓ Yes |

TiBook is not just an invoice generator — it's a complete invoicing system built for growing businesses.

Invoicing Made Simple for Growing Businesses

Generate invoices with 100% accuracy in the blink of an eye using TiBook's free invoice generator and focus more on your business growth.

Industry-Specific Invoice Templates

TiBook offers ready-made invoice templates tailored for different industries:

Trades

- • Contractor Invoice Template

- • Construction Invoice Template

- • Plumbing Invoice Template

- • Electrician Invoice Template

- • HVAC Invoice Template

- • Landscaping Invoice Template

- • Handyman Invoice Template

Business & Professional Services

- • Consulting Invoice

- • Marketing Invoice

- • Legal Invoice

- • Retainer Invoice

Health & Services

- • Medical Invoice

- • Therapy Invoice

- • Personal Training Invoice

Try Our Free Tools

Create your purchase order in a minute.

Get StartedFreely generate receipts for any business.

Get StartedBuild your business estimate online with this tool.

Get StartedExplore more free business tools:

Frequently Asked Questions

If you have any further questions, please don't hesitate to reach out to our customer support team for assistance.

Create, send and manage invoices online with TiBook

Professional templates | Online payments | Client management | Estimates | Payment tracking | Cloud access

Start Free Now